I’ve seen this before

At first sight, today’s Greece fairly resembles Argentina of 2002. Fall of the GDP, regression of industrial activity and of profitability, exponential growth of unemployment, permanent flight of deposits from the banking system, increasing pressure of debt because of successive bailouts that failed to reverse the situation. All of which is crowned by the failure of different governments (social democrats, conservatives and of coalition) in stabilizing the situation through adjustments policies. And this is within a framework of mass mobilization and discontent.

In this scenario, earlier this year the Coalition of the Radical Left (Syriza) won the elections, positioning Alexis Tsipras as prime minister and the party only two seats away from absolute majority in the Parliament. Other noteworthy results were the steep fall of the social democratic party (PASOK) and the third position obtained by the neo-Nazi party Golden Dawn. The elections express the mood of the masses towards the crisis, although also, in a context of polarization, a danger of creating illusions in already failed experiences.

The triumph of the self-proclaimed broad and innovative New Left aroused the emotion of progressivism and even of wide sectors of the world’s left, excited by the possibility of changing the world within the rules of the system. Cristina, Maduro, Dilma and Evo saluted their “comrade” Tsipras as being a popular advance against neoliberalism and a hope for the people of Europe1. The identification of these kind of governments with Syriza is logical, since this party based its campaign on a program of Keynesian recipes aiming to stimulate consumption through public spending, identified with Latin America’s recent experience.

But Syriza’s tragic difficulty to establish a kind of Balkan “bolivarianism” is that, unlike Chavez or Correa (oil), Evo (gas and minerals) or Nestor Kirchner (soybean), Greece doesn’t have the elements that would allow reissuing that model. Syriza’s margin of manoeuvre is limited, and the perspective the working class faces under this direction is the deepening of misery.

From tragedy to farce

What Syriza outlines isn’t radical either in political terms or at a historical level. During the 1980s the social democratic party PASOK had a similar program. In 1981 Andreas Papandreu took office, denouncing NATO and the European Community led by bankers, promising a raise in wages, and presenting his party as the party of the non-privileged against the financial oligarchy. Once in power, he applied a program of expenditure and subsidies to sectors like the agriculture. Free health and education were expanded, particularly in the rural area. A “socialization of companies” was established, which was socialist only in name: it consisted in adding workers representatives in the companies’ board of directors (in Papandreu’s second term, after denunciations of corruption to favor PASOK militants, that practice was abandoned).

These measures were supported with debt: public debt grew from 18% of GDP in the 1970s to almost 50% in the 1980s. That is why Papandreu abandoned his campaign rhetoric and allowed the USA to keep military bases in exchange for financing.

But in 1986, during his second term, facing a crisis, he had to reduce public spending and apply an austerity plan. The drachma was devalued and price control and wage freeze were decreed. As a consequence, popular mobilizations ensued, with two general strikes in 1986 and 1987. PASOK lost the country’s main municipalities in the next elections, initiating its political decline until final exit in 19892.

This experience has many points in common with Syriza’s current program and with the trajectory of Latin America’s populisms. Some would argue that the failure was because the neoliberal assault was stronger than the forces of change. And that now there is an opportunity, if finances can be kept in check and the debt pressure is unburdened. The question is if Greece can achieve that goal outside the international credit systems, and even the European Union. The issue is beyond the debt: it is rooted in the country’s economic structure.

Crisis and ¿opportunity?3

Since 2008, Greece’s socio-economic indicators are plummeting: the GDP shrunk by 25% (the fifth position among the countries that contracted the most). The industrial activity fell and the productivity of labor stagnated or even decreased since 2010, an unusual case in the world. The industrial rate of profit collapsed, registering negative values in 2013. The real wage in the manufacturing industry lost a fifth of its value. Recession, default and rumors of a possible exit from the European Union manifested in a constant outflow of deposits from the financial system, decreasing by a third since the end of 2010. The unemployment rate, which until the mid-2000s was close to the general average in Europe, shot up to nearly 30%. Among young people the situation is even worse: for those under the age of 25, unemployment is almost 60%, which makes Greece the country with the third highest unemployment rate in that sector of the population, after Bosnia and Kosovo. Total public debt amounted to 175% of the GDP in 2013 and 1.115% of exports.

In 2009, the international crisis and the difficulty to get access to financial markets made impossible for Greece to cover its deficit. This made Yorgos Papandreu ask the EU and the IMF for help. This “life jacket” had as a counterpart, the implementation of an adjustment plan, which consisted in reducing public spending, and cutting wages in the administration and pensions. At the same time, he decreed a tax increase in special rates and in VAT. A second stage of the adjustment advanced again over public wages and employees special bonuses, along with cuts in social expenditure. The protests and the depth of the crisis brought down the Prime Minister, who resigned by the end of the year. Two brief internships ensued (Papadimos and Pikramenos) until Antonis Samaras, conservative leader (of New Democracy), took office in mid-2012.

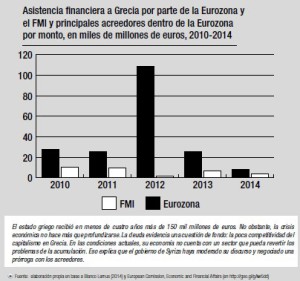

That year the EU made a second bailout. These fluxes were made through two tools created to finance countries in crisis, like Ireland, Portugal, Cyprus and, of course, Greece. Through the European Financial Stability Facility and the European Stability Mechanism, Greece received, between 2010 and 2014, over 150 thousand million euros. In 2014, Greek authorities managed to put debt in the market, appearing to have overcome the crisis, with the approval of Germany4. However, neither the internal pressure nor the tensions with the EU for the payments falling due and the adjustment measures were alleviated, which provoked a political crisis that advanced the elections of 2015.

The result is well known: discontent over six years of hardships led to the discredit of the social democrats and the conservatives. New figures and groups grew outside that arch, like Syriza, but also nationalists and neo-Nazis. In this way, Tsipras came to power with a Keynesian program: increase in public investment of at least 4 thousand million euros; dismantling of the adjustment agreed with the EU and other lenders in the 2010-2013 period; recomposition of pensions and wages; promotion of consumption; incentives to SMEs to create jobs; energy subsidies for industries; policies of retention and repatriation of young scientists and the reconstruction of the Welfare State; among other things. Evidently, it’s not about any revolutionary change. Furthermore, important points of the program are already being turned down. In the last days and after arduous negotiations, European creditors agreed upon a four months extension of the bailout, basically with disbursements to pay interests, and with Athens’s promise to maintain the austerity policy5.

The debate over Greece was about two issues. On the one hand, it was about exalting the oppressive weight of the debt, the EU’s blackmail, the pillage and corruption of different governments. On the other hand, the discussion was about the viability of Syriza’s position of neglecting the debt or demanding a reduction, even until exiting the euro (a position that was abandoned only a month after the elections). But the issue is beyond the debt and its burden. What is to be determined is if Greece has the conditions to apply Syriza’s plan to come out of the crisis, and what is the perspective for the working class.

Debt is not the issue

The debt expansion is a manifestation of a bigger problem. The process hides deeper issues of the Greek economy, which the flow of resources has helped to postpone for years, as we saw in the 1980s. Those structural difficulties are the serious limits to any kind of “Bolivarian” policy. Greece is a country with a relatively small market. Therefore its economy is also small: within the EU, it only has the fifteenth position in that aspect. Regarding population, it’s the eighth country, with only 61% in urban centers. The structure that has to be maintained is smaller than other countries, but its own resources to do so are also smaller.

As to the pillars of the economy, the public sector represents about 40% of the GDP and it employs 31% of the labor force. Among the other activities, tourism is fundamental, contributing almost a fifth of GDP, while industry has 15% and agriculture 3,5%. About 20% of the labor force is made of immigrants, working mostly in agriculture or unskilled jobs.

The country’s most relevant industries are related to natural resources: fishing and olive oil. Then there are the ones related to the internal market, such as food industry, textile, chemicals and medications, metals, and refining of crude oil. Some of these products are exported, especially to Balkan countries and others nearby, like Turkey, Bulgaria, Italy, and others of the EU. But in this aspect the economy is deficient. In 2008 the deficit amounted to 63 thousand million dollars, and has been reducing since then because the import capacity has been steadily falling also. Deficit can be observed in almost all areas of production, particularly concerning industrial goods (machinery, vehicles, consumption goods) and fuels. Because of the crisis and the difficulty to import, the deficit in 2013 was the lowest in recent years: almost 25 thousand million dollars.

Greece is a net food importer, with surplus only in “fruits and vegetables”. Since 1980 food imports represent between 8 and 10% of total imports (and 5% of the commercial deficit). The deficit is mitigated by tourism, since it is a country which receives many visitors. From 2005 to 2012, net income from tourism was more than 10 thousand million dollars each year. The combination of diminishing imports with rising incomes from tourism has reduced the deficit by 67% since 2008. However, the economy remains deficient, which obliges to cover the balance of payments with resources from external financing.

The labor cost isn’t also attractive enough to make Greece function as a vacuum of capitals for exports. Since 2008, in the manufacturing industry wages lost a fifth of their real value, and labor cost was reduced. By 2012 it was 20% less than the one in Spain and 50% less than the ones in EEUU, France and Germany. However, it still is far away from the countries that use that variable as a way of competing in the world (Asia), and even the countries that compete through cheap industrial labor for the European market: they are between 50 and 100% superior to the ones in Czech Republic and Hungary, 100% bigger to the Brazilian and the Taiwanese, and twice as expensive as the Mexicans. Currently, Greek labor cost is at the level of the Argentinian or the Korean. Argentinian wages in Europe. Workers are poor, but expensive for capital6.

Grim prospects

Tsipras took office with a Keynesian expansion program. An admirer of Chavez and of Latin America’s populisms, he replicated that proposal to win the sympathy of the discontent Greek masses that have been fighting against adjustment policies for years. The global left was encouraged with his anti-neoliberal discourse, against adjustment and against EU financiers. But Syriza doesn’t have anything to replicate Keynesian policies. Historically, the expansion through public spending was only possible over 50 million bodies, after a world war and its massive destruction of capital. Or in countries that can sustain in the long run the fiction of stability, by issuing bonds (the USA, the powers of Europe); or in regions that produce raw materials as sources of differential rent, like the Latin American countries in the last decade. Greece doesn’t seem to have any of these sources.

Without changing the relations of production, the prospects imply more hardships than solutions for the Greek masses. Syriza could decide to throw out the window its program and restart the cycle of debt, which is in part what is doing. In effect, since taking office Tsipras and his minister Varoufakis desperately sought an agreement with the EU, mellowing day after day his campaign discourse of confrontation with the Union in general and Germany in particular. It’s not a problem of the government in office, but a consequence of the fact that the Greek economy needs financing since it has no other resources. This path has the government again facing adjustment policies demanded by creditors and the working class facing a new disillusion, which can benefit the extreme right. Appealing to other lenders like Putin depends on the health of the Russian economy after the fall in the price of oil; and also it can open conflicts with the EU, because of the tensions between those blocs over Ukraine, something Athens intends to avoid. Financing from China was an option considered. Although there were intentions from Beijing, no concrete measures of rapprochement were taken. Much less since Syriza left ineffective the privatization plan of the Piraeus Port, stopping Chinese business there7. Another possibility is the complete collapse of labor cost, to make it closer to the Asian level, seeking to attract capitals. This would provoke greater social commotions and the exponential growth of the extreme right.

The exit from the euro was an option considered during the campaign. Returning to the drachma would free the government’s hands to issue/devalue. Maybe the government remembers the experience of Argentina, where the devaluation allowed certain recovery of the industrial activity, but forgets that Nestor Kirchner’s government had soybean with record prices. Greece doesn’t have resources that generate rent, like oil or agricultural goods. A devaluation would imply a sharp contraction of the economy, raising the price of industrial imports and of food for the working class. In other words: a wage reduction, new social conflicts and no concrete result for capital. Tourism could be an option to bet on in a context of devaluation, offering cheap prices and labor in that sector, but it could hardly sustain the accumulation without a general debacle of the conditions of life and of the imports of goods, which would reduce the size of the economy to make it compatible with income created by tourism. Tsipras wants to be Chavez, or at least Evo or Nestor, but he can’t be any more than a Duhalde, (who was president of Argentina from early 2002 until Kirchner’s access to power, in May 2003). Tsipras doesn’t have anything to sustain the accumulation with, that’s why he backed off from his campaign discourse and agreed with the Germans to sustain the debt. At this point, debt is not a problem, but rather an artificial respirator that allows to hang on for a few more months. Despite the toughness demonstrated in the negotiation, Germany also benefits from this solution, since it sustains a market and the fiction that its bonds have value.

The fact is that any possible way out implies worst conditions for the working class. Syriza has come to apply the adjustment from the left, given the failure of previous policies. The only way for the workers to face the crisis is by getting over reformist illusions, and advancing in a true socialization of the means of production.

Notas

1 La Razón (Bolivia), 28/1/2015, http://goo.gl/DDeh3g; Télam, 3/2/2015, http://goo.gl/zcdz4J; Euronews, 7/2/2015, http://goo.gl/Foj1Hx

2 Based on De Cabo, Isabel: Turquía, Grecia, Chipre. Historia del Mediterráneo oriental, U. de Barcelona, 2005 and Clogg, Richard: Historia de Grecia, Akal, 2003.

3 From here onwards the statistical information corresponds to information gathered in: Hellenic Statistical Authority, World Bank, CIA: The World Factbook, Bank of Greece, base UN Comtrade, Bureau of Labor Statistics (EEUU).

4 El País, 20/4/14, http://goo.gl/oMujXN.

5 ABC, 21/2/15; http://goo.gl/lxuglV.

6 Rodríguez Cybulski, Viviana: “Pobres pero caros”, El Aromo n° 70, 2013.

7 The Guardian, 9/2/15, http://goo.gl/cW8cX3.